Lifestyle credit cards

SBI PRIME

- Fees

- Annual Fee (one time): Rs. 2,999 + Taxes

- Renewal Fee (per annum): Rs. 2,999 + Taxes from second year onwards

- Add-on Fee (per annum): Nil

- Waiver of Renewal Fee on annual spending of Rs. 3 Lakhs

- Welcome gift:

- Welcome e-gift Voucher worth Rs. 3,000 from any of the following brands: Bata/Hush Puppies, Pantaloons, Aditya Birla Fashion, Shoppers Stop, and Yatra.com

- You will receive an SMS to choose from e-voucher options within 15 days of the annual fee payment. The e-voucher will be sent to your registered mobile number/e-mail ID, within 5 days of the request

- For Bata/ Hush Puppies, Pantaloons, Shoppers Stop, you can redeem your e-Gift Voucher by showing the code at the respective brand store

- For Yatra and Shoppers Stop you can redeem the code online at the time of purchase

- Aditya Birla Retail Voucher can be redeemed at these brand stores – Louis Philippe, Van Heusen, Allen Solly, Peter England, Planet Fashion, Simon Carter.

- PRIME Rewards

- Get 20 Reward Points per Rs. 100 spent on standing instructions of Utility Bills payments, w.e.f. 1 Oct ’19, a capping of 3,000 Reward Points per month will be placed on this earning

- Get 10 Reward Points per Rs.100 spent on Dining, Groceries, Departmental stores and Movies

- Earn 2 Reward Points per Rs. 100 on all other retail spends

- Pay your card outstanding with Reward Points. 4 Reward Points = Rs. 1

- 1% Fuel Surcharge Waiver on transaction amount ranging from Rs.500-Rs.4000 across all petrol pumps. (Govt. Service Tax extra, as applicable). Maximum Surcharge Waiver of Rs.250 per month, per credit card account

- RPs applicable on Utility SI transactions can be earned for registrations done through SBI Card platforms (Mobile App/Website/Agents) only.

- Milestone Benefits

- Get Pizza Hut e-Voucher worth Rs. 1,000 on achieving spends of Rs. 50,000 in a calendar quarter

- Waiver of Renewal Fee on annual spending of Rs. 3 Lakhs

- E-Gift Voucher worth Rs. 7,000 from Yatra.com/Pantaloons on achieving annual spends of Rs. 5 Lakhs

- Pizza Hut e-Voucher will be sent to your registered mobile number within 15 days of achieving spends of Rs. 50,000

- For Yatra.com/ Pantaloons, you will receive an SMS to choose the e-Gift Voucher option within 10 days of achieving spends of Rs. 5 Lakhs.

- Trident Privilege Membership

- Enjoy complimentary Trident Privilege Red Tier Membership

- Get exclusive 1,000 Welcome Points on registration

- Enjoy 1,500 Bonus Points on your first stay & additional Rs. 1,000 hotel credit on an extended night stay, by clicking Click here & using Promo code: SBITH

- Enjoy 10% instant saving on bookings through the hotel website

- Enjoy 10 points for every Rs.100 spent (excluding taxes) during your stay at participating hotels

- Offer is valid for Primary Cardholders only

- Club Vistara Membership

- Enjoy Complimentary Club Vistara Silver membership

- Get 1 Upgrade Voucher

- Earn 9 Club Vistara Points for every Rs. 100 spent on Vistara flights

- Click here to apply for your exclusive Club Vistara Silver membership

- Offer is valid for Primary Cardholders only

- Lounge Access

- 4 complimentary visits per calendar year to International Priority Pass Lounges, outside India (max. 2 visits per quarter)

- 8 complimentary visits per calendar year to Domestic VISA/Mastercard Lounges in India (max. 2 visits per quarter)

- Offer is valid for Primary Cardholders only

- Birthday Benefit

- Enjoy 20 Reward Points per Rs. 100 spent on your birthday

- Mastercard/Visa Privileges

- 4 complimentary rounds on Green Fees per year and 1 complimentary golf lesson per month at select courses in India

- Exclusive benefits across 900 luxury hotels worldwide

- Savings of 10% off on Hertz car rental and up to 35% off on Avis Car Rentals

- Earn up to 10,000 miles per night on hotel stay, plus 25% extra miles on Kaligo.com

- Up to 8% Discount on bookings through hotels.com across the Asia Pacific

- Enjoy 15% off on luxury Airport Transfer Service

Lifestyle and Cashback credit cards

SBI SimplyClick

- Fees

- Annual Fee (one time): Rs. 499

- Renewal Fee (per annum): Rs. 499 from the second year onwards. Renewal Fee reversed if annual spends for last year >= Rs.1,00,000

- Add-on Fee (per annum): Nil

- Log-in Gift

- Get Amazon.in gift card worth Rs.500* on joining

- e-Shopping Rewards

- Earn 10X Reward Points on online spends with exclusive partners – Amazon / BookMyShow / Cleartrip / Lenskart / Netmeds / UrbanClap

- Earn 5X rewards on all other online spends

- Earn 1 reward point per Rs.100 on all other spends

- Please click here for detailed Terms and Conditions

- Milestone Rewards

- e-voucher worth Rs.2,000 on annual online spends of Rs.1 Lakh

- e-voucher worth Rs.2,000 on annual online spends of Rs.2 Lakhs

- Voucher Brand: Cleartrip

- Voucher code and other relevant details will be sent via SMS to your registered mobile number

- Please click here for detailed Terms and Conditions

- Enjoy Complete Fuel Freedom

- 1% fuel surcharge waiver for each transaction between Rs 500 & Rs 3000 (exclusive of GST, wherever applicable, & all other charges)

- Maximum surcharge waiver of Rs 100 per statement cycle, per credit card account

- Annual Fee Reversal

- Spend Rs 1,00,000 and get an annual fee of Rs 499 reversed for your SimplyCLICK SBI card in the subsequent year

- Contactless Technology

- Simply wave your card at a secured reader and your transaction is done

- Maximum payment of Rs 2,000 allowed per contactless transaction

Travel and Fuel credit cards

SBI Air India Signature Card

- Annual Fee ( one time) : Up to Rs. 4,999.

- Renewal Fee (per annum): Rs. 4,999 from second year onwards

- Welcome Gifts: Earn 20,000 reward points as a welcome gift on payment of the joining fee. Secure complimentary membership of the Air India frequent flyer program-flying returns.

- Features

- Lost Card Liability Cover

- Enjoy complimentary lost card liability cover of Rs. 1 lakh

- This cover is applicable from the period of 48 hours prior to reporting of loss till 7 days post the reporting of loss

- Access Cash Anytime, Anywhere

- Withdraw cash from over 1 million Visa ATMs worldwide including over 18,000 Visa ATMs in India. You can also withdraw from 10,000 State Bank of India ATMs across 100 cities in India

- Fuel Surcharge Waiver

- Get a 1% fuel surcharge waiver with your Air India SBI Signature Card, across all petrol pumps

- Purchase fuel worth Rs. 500 to Rs. 4,000, to avail this benefit

- Get maximum surcharge waiver of Rs. 250 per statement cycle. Applicable taxes extra wherever applicable

- Global Acceptance

- Accepted at over 2 million Visa outlets worldwide and over 2,85,000 outlets in India

- Empower your Family

- Empower your family by applying for add-on cards for your spouse, parents, children, or siblings above the age of 18

- Easy Bill Pay Facility

- Never miss the due date for paying your electricity, insurance, telephone, and other utility bills, with the Easy Bill Pay facility on your card

- Railway Ticket Booking

- Easy Bill Pay Facility

- With your Air India SBI Signature Card, you can book railway tickets online and get them delivered at your doorstep.

- Emergency Card Replacement

- Get your Air India SBI Signature Card replaced anywhere in the world

- 24×7 helpline for emergency card replacement even while traveling

- Abroad

- Lost Card Liability Cover

Travel credit cards

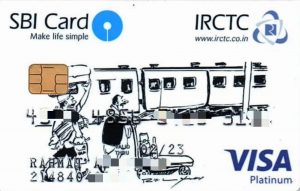

SBI IRCTC Credit Card

- Annual Fee (one-time): Rs. 500

- Renewal Fee (per annum): Rs. 300

- Add-on Fee (per annum): Nil

- Welcome Gift

- Get 350 activation bonus Reward Points on a single transaction of Rs. 500 or more within 45 days of card issuance. Fuel and Cash spend are not included.

- Earn Rs. 100 cashback on your first ATM cash withdrawal within 30 days of receiving the card

- Bonus Reward Points will be credited to the IRCTC SBI Platinum Card account within 45 days of the eligible transaction

- Value Back Benefits

- Buy tickets through irctc.co.in for AC1, AC2. AC3 and AC CC and earn up to 10% Value back as Reward points. (1 Reward Point = Rs. 1)

- Get 1 Reward point for every Rs. 125 spent on non-fuel retail purchases, including railway ticket purchases at irctc.co.in

- Link your IRCTC SBI Card loyalty number with your irctc.co.in login id, to redeem your reward points

- Travel Offers from IRCTC

- Save 1% transaction charges on railway ticket bookings on irctc.co.in

- Log on to irctc.co.in and avail of exclusive travel privileges

- Book your airline tickets with IRCTC at unbeatable prices

- Get a wide range of tailor-made packages ranging from adventure, wildlife, pilgrimage, and leisure tours to various places in India

- Avail accommodation at over 5,000 hotels, covering 350 cities in India

- Save 1% transaction charges on railway ticket bookings on irctc.co.in

- Fuel Surcharge Waiver

- Enjoy freedom from paying the 1% fuel surcharge across all petrol pumps in India, on transactions of Rs. 500 – Rs. 3,000, exclusive of GST and other charges

- Get maximum surcharge waiver of Rs. 100 per statement cycle per credit card account

- Other features:

- Visa Offers: You get exclusive privileges from Visa including great deals on entertainment, travel, dining, and golf.

- Global Acceptance: The IRCTC SBI Platinum Card is accepted worldwide at over 29 million merchant outlets and at 3,25,000 merchant outlets in India, through the Visa payment gateway.

- 24/7 Assistance: State Bank of India provides 24/7 Visa Global Customer Assistance and the IRCTC SBI Platinum Card Customer Helpline to cardholders to help them during any emergency situation.

- Utility Bill Payments: You can easily pay your utility bills like telephone bills, electricity bills, insurance, etc. without any hassles. SBI provides this service to its customers free of cost.

- Add-on Cards: You can also apply for add-on cards for your spouse, parents, children, and siblings above the age of 18, without additional charges.

- Flexipay: Using the Flexipay feature, you can convert all your purchases over Rs.2,500 into EMI within 30 days of the transactions.

Cashback credit card

SBI FBB StyleUP Credit Card

- Annual Fee (one-time): Rs. 499 + GST

- Renewal Fee (per annum): Rs. 499 + GST

- Add-on Fee (per annum): Nil

- Welcome gift

- 500 worth Fbb gift voucher

- Anniversary gift* of 2,000 Bonus Reward Points every year

- FBB Gift Vouchers can be redeemed at any Big Bazaar/ FBB store, against select fashion categories only*.

- Gift Voucher should be redeemed in full. Partial or cash redemption is not valid.

- No duplicate Gift Voucher will be reissued in case it’s lost or misplaced. Voucher Validity is of 1 year from its date of issue

- Discount Waiver

- An upfront discount* of flat 10% round the year, whenever you shop for Fashion Apparel, Accessories, Backpacks, Footwear & School Bags at Fbb and Big Bazaar Stores

- 5% on FBB/Big Bazaar, 2.5% on Food Bazaar & dining

- No cap on count or value of daily, monthly, or yearly discount transactions

- 10X Reward Points on your spending at Big Bazaar, Standalone Fbb, and Food Bazaar outlets, and on all your Dining expenditures

- Fuel Surcharge Waiver

- Get freedom from paying the 1% fuel surcharge on every transaction of Rs. 500 to Rs. 3,000

- A maximum surcharge waiver of Rs. 100 can be availed per cycle on your STYLEUP Card

Premium credit card

SBI Elite

- Fees

- Annual Fee (one-time) :4,999

- Renewal Fee (per annum): 4,999 from second year onwards

- Add-on Fee (per annum): Nil

- Welcome Gift

- Voucher worth 5,000

- Choose from an array of travel and lifestyle brands: Yatra, Hush Puppies/Bata, Pantaloons, Aditya Birla Fashion, and Shoppers Stop

- You will receive an SMS to choose from e-voucher options within 15 days of the annual fee payment. The e-voucher will be sent to your registered mobile number/e-mail ID, within 5 days of the request.

- For Pantaloons, Shoppers Stop, and Hush Puppies /Bata you can redeem your e-gift voucher by showing the code at the respective brand store

- For Yatra and Shopper Stop you can redeem the code online at the time of purchase

- Aditya Birla Retail Voucher can be redeemed at these brand stores – Louis Philippe, Van Heusen, Allen Solly, Peter England, Planet Fashion, Simon Carter

- Complimentary Movie Tickets

- Free Movie Tickets worth Rs. 6,000 every year

- Transaction valid for at least 2 tickets per booking per month. The maximum discount is Rs. 250/ticket for 2 tickets only. Convenience Fee would be chargeable

- This offer is valid on Primary Cards only

- Milestone Privileges

- Earn up to 50,000 Bonus Reward Points worth Rs. 12,500/ year

- Earn 10,000 bonus Reward Points on achieving annual spends of Rs. 3 lakhs and 4 lakhs

- Earn 15,000 bonus Reward Points on achieving annual spends of Rs. 5 lakhs and 8 lakhs

- Spend Based Reversal of Annual Fee on spends of Rs. 10 Lakhs

- ELITE Rewards

- Get 5X Reward Points on Dining, Departmental Stores, and Grocery Spends

- Earn 2 Reward Points per Rs. 100 on all other spends, except fuel

- Pay your card outstanding with Reward Points. 4 Reward Points = Rs. 1

- 1% Fuel Surcharge Waiver across all petrol pumps. (Govt. Service Tax extra as applicable). Maximum Surcharge Waiver of Rs. 250 per month per credit account

- International Lounge Program

- Complimentary membership to the Priority Pass Program worth $99

- 6 complimentary Airport Lounge visits per calendar year, outside India ( max. 2 visits per quarter)

- Access over 1000 Airport Lounges worldwide

- Only Primary Cardholders are eligible for Priority Pass and complimentary membership will be valid for 2 years only

- Domestic Lounge Program

- Enjoy 2 complimentary Domestic Airport Lounge visits every quarter in India

- To avail of the offer, please use your SBI Card ELITE at the respective lounges

- This offer is brought to you by Visa /MasterCard and is for a limited period only

- Club Vistara Membership

- Enjoy complimentary Club Vistara Silver membership

- Get 1 complimentary Upgrade Voucher

- Earn 9 Club Vistara Points for every Rs. 100 spent on Vistara flights

- Offer is valid for Primary Cardholders only

- Trident Privilege Membership

- Enjoy complimentary Trident Privilege Red Tier membership

- Get exclusive 1,000 Welcome Points on registration

- Enjoy 1,500 Bonus Points on your first stay & additional Rs. 1,000 hotel credit on an extended night stay

- Enjoy 10% instant savings on bookings through the hotel website

- Enjoy 10 points for every Rs.100 spent (excluding taxes) during your stay at participating hotels

- Offer is valid for Primary Cardholders only

- Lowest Forex Markup

- Your SBI Card ELITE offers you the privilege of the lowest Foreign Currency Mark-up Charge of 1.99% on International usage.

- You are also entitled to 2 Reward Points on every Rs.100 spent on International transactions.

- Exclusive Concierge Service

- Dedicated assistance on Flower Delivery, Gift Delivery, Online Doctor Consultation.

Fuel credit card

BPCL SBI Credit Card

- Fees

- Joining fee, one time: 499

- Renewal fee, per annum: Up to 499, from second year onwards, Renewal Fee reversible if annual spends for last year ≥ Rs. 50,000.

- Add-on fee, per annum: Nil

- Welcome Gift

- Get 2,000 Activation Bonus Reward Points worth Rs. 500 on payment of joining fee

- Reward Points will be credited after 20 days of the payment of the joining fee and the same can be redeemed instantly against fuel purchases at BPCL outlets, BPCL Vouchers, or at Shop n Smile rewards catalog.

- Value Back Benefits

- 25% Value back ~ 13X* Reward Points on fuel purchases at BPCL petrol pumps. Maximum 1300 Reward Points per billing cycle

- 25% + 1% Fuel surcharge waiver on every transaction up to Rs. 4,000

- Reward Benefits

- 5X Reward Points on every Rs. 100 spent at Groceries, Departmental stores, Movies & Dining.

- Get 1 Reward Point for every Rs. 100 spent on non-fuel retail purchases.

- 4 Reward Points = Re 1.

- Flexible Instant Redemption Program at select 1200 BPCL petrol pumps.

- No minimum threshold of Reward Points for redemption.

- Fuel Freedom Benefits

- 25 % Value back (13X* Reward Points equivalent to 3.25% + 1% Fuel surcharge waiver on every transaction of up to Rs. 4,000), at any BPCL petrol pump across the country.

- Maximum surcharge waiver of Rs. 100 in a month, which is equivalent to an Annual Savings of Rs.1200.

- The maximum limit in a month Rs. 10,000.

- No Minimum Threshold. Surcharge Waiver applicable only on transactions up to Rs. 4,000/- for a max of Rs. 100/- per month.

- Annual Savings of 70 liters of fuel,

Disclaimer

We give details according to specific bank data. But remember before going to pick up anyone’s Credit card must visit the respective Bank’s website. Check the details of the card like Fees, Interest rate, Rewards, etc. because it maybe changes. Hence you need to be aware of the changes happening in most out of your credit cards.

The information and services included on this Web site may include discrepancies. Paidkiya will not be liable/responsible for any decision that you may take based on such inaccurate information. Changes are periodically added to Bank’s websites.